How to Build Business Credit Without Using Personal Credit

Building business credit without relying on personal credit is crucial for entrepreneurs aiming to separate personal and business finances.

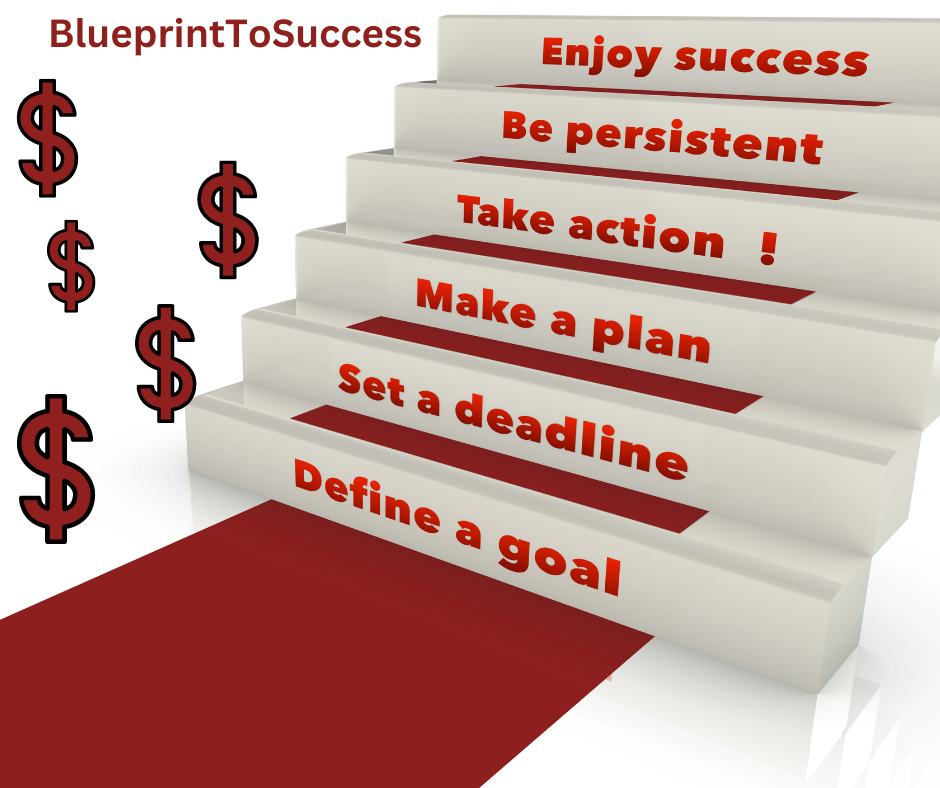

This strategy not only safeguards personal assets but also strengthens the business's financial foundation. Here’s a step-by-step guide to achieving this:

1. Incorporate Your Business

Incorporating your business is a pivotal step to establish a distinct legal entity. There are several ways to do this:

LLC (Limited Liability Company): Protects personal assets while creating a separate business entity.

Corporation (S-Corp or C-Corp): Offers tax advantages and additional credibility to lenders.

Incorporation helps build credibility with financial institutions and vendors, separating personal and business liabilities.

2. Obtain an Employer Identification Number (EIN)

An EIN is like a Social Security number for your business. It's a unique identifier that the IRS uses to track business income and taxes. Having an EIN is critical because:

It separates your business from personal credit: Lenders and credit bureaus use the EIN to track your business credit history.

It's mandatory for tax filings: For businesses that plan to hire employees, an EIN is required.

Obtaining an EIN is a straightforward process and can be done through the IRS website.

3. Open a Business Bank Account

A business bank account further separates your business finances from your personal finances. This is a critical step for proving your business's legitimacy to lenders.

Choose a business checking account with a reputable bank and ensure all business transactions are conducted through this account.

Track business expenses: Keeping personal and business transactions separate simplifies accounting and makes tax preparation easier.

Build a banking relationship: Over time, this relationship can lead to better financing opportunities and access to credit.

4. Register with Business Credit Bureaus

To establish a credit profile independent of your personal credit, it’s essential to register your business with major business credit bureaus. The primary ones are:

Dun & Bradstreet (D&B): This is one of the largest and most recognized business credit reporting agencies. Obtain a D-U-N-S number, which is necessary for a credit profile.

Experian Business: This bureau gathers information on businesses of all sizes, including credit inquiries, legal filings, and public records.

Equifax Business: Similar to personal credit, Equifax tracks your business’s credit history and reports it to lenders and suppliers.

By registering with these agencies, your business begins to build a distinct credit history.

5. Establish Trade Lines with Vendors

Vendor credit is a valuable tool in building business credit. Many vendors offer “Net 30” or “Net 60” terms, allowing businesses to buy now and pay later. These vendors often report payment history to credit bureaus.

Choose vendors that report to business credit bureaus: Ensure that the vendors you work with report payment activity to D&B, Experian, or Equifax.

Build a positive payment history:

Pay invoices on or before the due date to build strong business credit quickly.

Examples of vendors that typically report to business credit bureaus include office supply companies, wholesalers, and shipping companies.

6. Apply for a Business Credit Card

Opening a business credit card is another effective way to build credit. Choose a card that does not require a personal credit guarantee to avoid mixing your personal and business credit. Look for credit card companies that offer:

No personal credit check: Some business credit cards are designed specifically for businesses without a strong personal credit history.

Rewards and cash-back benefits: Cards that offer rewards for business spending can help offset costs.

Using the business credit card responsibly — making timely payments and keeping balances low — will positively impact your business credit score.

7. Maintain a Good Payment History

One of the most important aspects of building business credit is maintaining a good payment history with creditors. Payment history accounts for a significant portion of your business credit score. To maintain a positive history:

Pay bills on time: Late payments can significantly harm your business credit.

Keep balances low: Avoid maxing out business credit cards or revolving credit accounts.

By demonstrating consistent financial responsibility, your business credit score will increase, and your business will be seen as a lower risk by lenders.

8. Monitor Your Business Credit Reports Regularly

Regularly monitoring your business credit reports helps you stay on top of your business’s credit profile and ensures that all information is accurate. Look for:

Errors or discrepancies: Dispute any inaccuracies on your report with the relevant bureau.

Late payments: Ensure all payments are reported correctly.

Monitoring your reports will also allow you to spot potential fraud or misuse of your business's credit.

9. Leverage Your Business Credit for Growth

Once your business has established a strong credit profile, leverage it to secure financing, expand operations, or invest in growth opportunities.

Lenders, investors, and partners will assess your business’s creditworthiness before extending offers, and a robust business credit profile can lead to favorable terms on loans, lines of credit, and vendor relationships.

Business and Credit Facts

| Topic | Part 1 | Part 2 |

|---|---|---|

| Business Insurance | Having business insurance is essential. | It protects against unexpected losses. |

| Interest Rates | Interest rates can significantly affect loan costs. | Always compare rates before accepting a loan. |

| Business Licenses | Most businesses need a license to operate legally. | Check local requirements to avoid penalties. |

| Business Networking | Networking can open doors to new opportunities. | It helps in finding partners, clients, and mentors. |

| Credit Card Rewards | Business credit cards often offer rewards. | These can include cash back, travel points, or discounts. |

| Budgeting | Creating a budget helps manage business finances. | It ensures you don't overspend and stay on track. |

| Loan Terms | Understanding loan terms is crucial before signing. | It prevents surprises like hidden fees or high penalties. |

| Customer Retention | Retaining customers is cheaper than acquiring new ones. | Loyal customers often spend more over time. |

| Business Grants | Some organizations offer grants to small businesses. | Unlike loans, grants don't need to be repaid. |

| Cost-Cutting | Reducing unnecessary expenses boosts profitability. | Regularly review your budget for savings opportunities. |

| Business Taxes | Paying taxes on time avoids penalties and interest. | Consider hiring an accountant for complex tax needs. |

| Personal Credit Impact | Using personal credit for business can be risky. | It may affect your personal credit score. |

| Loan Collateral | Collateral can secure better loan terms. | But it also means risking valuable assets. |

| Seasonal Businesses | Seasonal businesses need careful planning. | Ensure you have enough funds to cover off-season periods. |

| Business Mentorship | A mentor can provide valuable business insights. | They can help you avoid common mistakes. |

| Credit Inquiries | Too many credit inquiries can lower your score. | Limit applications to necessary ones. |

| Vendor Relationships | Building strong vendor relationships can be beneficial. | It may lead to better terms and discounts. |

| Employee Benefits | Offering benefits can attract and retain talent. | It improves employee satisfaction and loyalty. |

| Diversifying Revenue | Diversifying revenue streams strengthens business. | It reduces dependence on a single source of income. |

| Business Forecasting | Forecasting helps predict future financial needs. | It aids in making informed decisions and plans. |

| Refinancing Loans | Refinancing can lower monthly payments. | But consider the total cost over time. |

| Business Reputation | A good reputation attracts customers and partners. | Manage it actively through quality service and communication. |

| Payment Terms | Offering flexible payment terms can attract more clients. | But ensure it doesn't harm your cash flow. |

| Technology Investment | Investing in technology can improve efficiency. | It can save time and reduce long-term costs. |

| Market Research | Conducting market research is vital before launching. | It helps you understand customer needs and competition. |

| Credit Utilization | High credit utilization hurts your credit score. | Aim to keep it below 30% of your total limit. |

Building Bisiness Credit

PodCast

Fans

us

"Yokcm LLC Helped Me Rebuild My Credit and Plan for Success"

The self-help tools provided by Yokcm LLC were instrumental in managing my finances effectively.

Kiera Warren@KIDkEIRA

"Yokcm LLC's Business Credit Services Boosted My Company’s Growth"

I'm grateful for the business credit building services that Yokcm LLC offered. It made a significant impact on my company's growth.

Abbie Banks@FitnessLife

Yes Yes Yes

Yokcm LLC helped me rebuild my credit and provided valuable insights for financial planning.

Lauren Webster@theLovelyBrunnete

James Tucker "Yokcm LLC really turned things around for me! As a small business owner, I was struggling to establish business credit. Their one-on-one consulting sessions gave me actionable steps that I could immediately implement. In just a few months, I saw significant improvements. Thank you, Yokcm LLC!"

Malcolm Bryant "I had no idea how bad my personal credit was until I reached out to Yokcm LLC. Kenneth and his team were patient and incredibly helpful. They guided me through each step of repairing my credit. Now, I'm in a position to start thinking about buying my first home! Couldn’t be happier with their service."

Tanya underwood "Yokcm LLC provided great insight into credit repair and business credit building. They made the process easy to follow, and I appreciate the DIY kits they offer for when you want to take control yourself.

Pros: Excellent customer service, clear instructions. Con: Some resources were a bit pricier than I expected."